All Categories

Featured

Table of Contents

This is despite whether the insured individual passes away on the day the policy begins or the day prior to the plan finishes. To put it simply, the quantity of cover is 'degree'. Legal & General Life Insurance Coverage is an example of a degree term life insurance policy plan. A degree term life insurance policy policy can fit a variety of conditions and needs.

Your life insurance policy plan can likewise develop component of your estate, so can be based on Inheritance Tax learnt more about life insurance policy and tax - Level term life insurance meaning. Let's take a look at some features of Life Insurance from Legal & General: Minimum age 18 Maximum age 77 (Life Insurance), or 67 (with Essential Disease Cover)

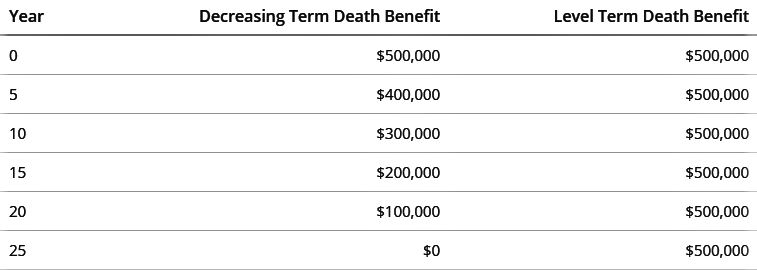

What life insurance policy could you take into consideration if not level term? Decreasing Life Insurance Policy can help shield a payment home loan. The amount you pay stays the very same, however the level of cover reduces approximately in line with the way a payment home mortgage decreases. Decreasing life insurance can help your liked ones remain in the family members home and avoid any kind of more disturbance if you were to pass away.

If you choose level term life insurance coverage, you can allocate your premiums since they'll stay the same throughout your term. Plus, you'll recognize precisely just how much of a death benefit your beneficiaries will get if you pass away, as this quantity will not change either. The rates for degree term life insurance will depend on a number of elements, like your age, health and wellness standing, and the insurance policy firm you choose.

When you go via the application and medical examination, the life insurance coverage company will evaluate your application. Upon approval, you can pay your very first costs and authorize any pertinent documentation to guarantee you're covered.

What Makes 10-year Level Term Life Insurance Unique?

You can select a 10, 20, or 30 year term and delight in the added tranquility of mind you are entitled to. Functioning with an agent can aid you locate a policy that works best for your needs.

As you try to find ways to safeguard your economic future, you have actually most likely encountered a broad range of life insurance policy choices. Picking the appropriate insurance coverage is a big choice. You intend to find something that will certainly aid sustain your liked ones or the reasons important to you if something takes place to you.

The Ultimate Guide: What is What Is Direct Term Life Insurance?

Lots of people favor term life insurance coverage for its simplicity and cost-effectiveness. Term insurance coverage agreements are for a relatively brief, specified time period however have options you can tailor to your demands. Particular benefit options can make your premiums change gradually. Degree term insurance, however, is a sort of term life insurance policy that has regular repayments and a changeless.

Level term life insurance policy is a subset of It's called "degree" due to the fact that your costs and the advantage to be paid to your loved ones remain the exact same throughout the agreement. You won't see any type of modifications in price or be left questioning its worth. Some agreements, such as annually eco-friendly term, may be structured with costs that raise gradually as the insured ages.

Repaired death advantage. This is likewise set at the beginning, so you can know specifically what fatality benefit amount your can expect when you pass away, as long as you're covered and updated on premiums.

You agree to a fixed premium and death benefit for the period of the term. If you pass away while covered, your fatality benefit will be paid out to loved ones (as long as your premiums are up to date).

Why Consider Term Life Insurance With Accelerated Death Benefit?

You may have the choice to for one more term or, more probable, renew it year to year. If your agreement has an assured renewability stipulation, you may not require to have a brand-new medical examination to keep your protection going. However, your costs are most likely to increase because they'll be based upon your age at renewal time.

With this choice, you can that will last the rest of your life. In this situation, again, you may not need to have any new clinical tests, but costs likely will rise because of your age and new protection (Term Life Insurance). Various firms use various alternatives for conversion, be sure to comprehend your options prior to taking this step

Speaking to a financial expert also might aid you determine the path that straightens ideal with your total technique. Many term life insurance policy is level term throughout of the contract duration, yet not all. Some term insurance may come with a premium that boosts in time. With decreasing term life insurance policy, your fatality benefit goes down with time (this kind is typically taken out to especially cover a long-term financial obligation you're repaying).

And if you're established for eco-friendly term life, after that your premium likely will increase each year. If you're discovering term life insurance policy and wish to guarantee simple and foreseeable monetary security for your family members, degree term might be something to consider. As with any kind of protection, it may have some limitations that don't satisfy your requirements.

What is What Is Direct Term Life Insurance? Key Points to Consider?

Typically, term life insurance policy is much more budget-friendly than permanent protection, so it's a cost-efficient way to safeguard financial defense. Adaptability. At the end of your contract's term, you have numerous options to proceed or carry on from protection, often without requiring a clinical test. If your spending plan or coverage requires change, fatality benefits can be decreased in time and lead to a lower costs.

As with other kinds of term life insurance, once the contract ends, you'll likely pay greater costs for coverage since it will certainly recalculate at your present age and health and wellness. If your monetary circumstance changes, you might not have the needed protection and could have to purchase extra insurance coverage.

But that does not indicate it's a fit for every person (Life insurance level term). As you're buying life insurance policy, right here are a couple of vital elements to think about: Budget plan. Among the advantages of degree term coverage is you know the expense and the death benefit upfront, making it easier to without fretting about rises gradually

Usually, with life insurance policy, the healthier and more youthful you are, the more budget-friendly the insurance coverage. Your dependents and financial duty play a function in determining your protection. If you have a young family, for instance, degree term can help supply monetary assistance during essential years without paying for insurance coverage longer than necessary.

Table of Contents

Latest Posts

Seniors Funeral Cover

Funeral Insurance Expenses

Instant Term Life Insurance

More

Latest Posts

Seniors Funeral Cover

Funeral Insurance Expenses

Instant Term Life Insurance