All Categories

Featured

Table of Contents

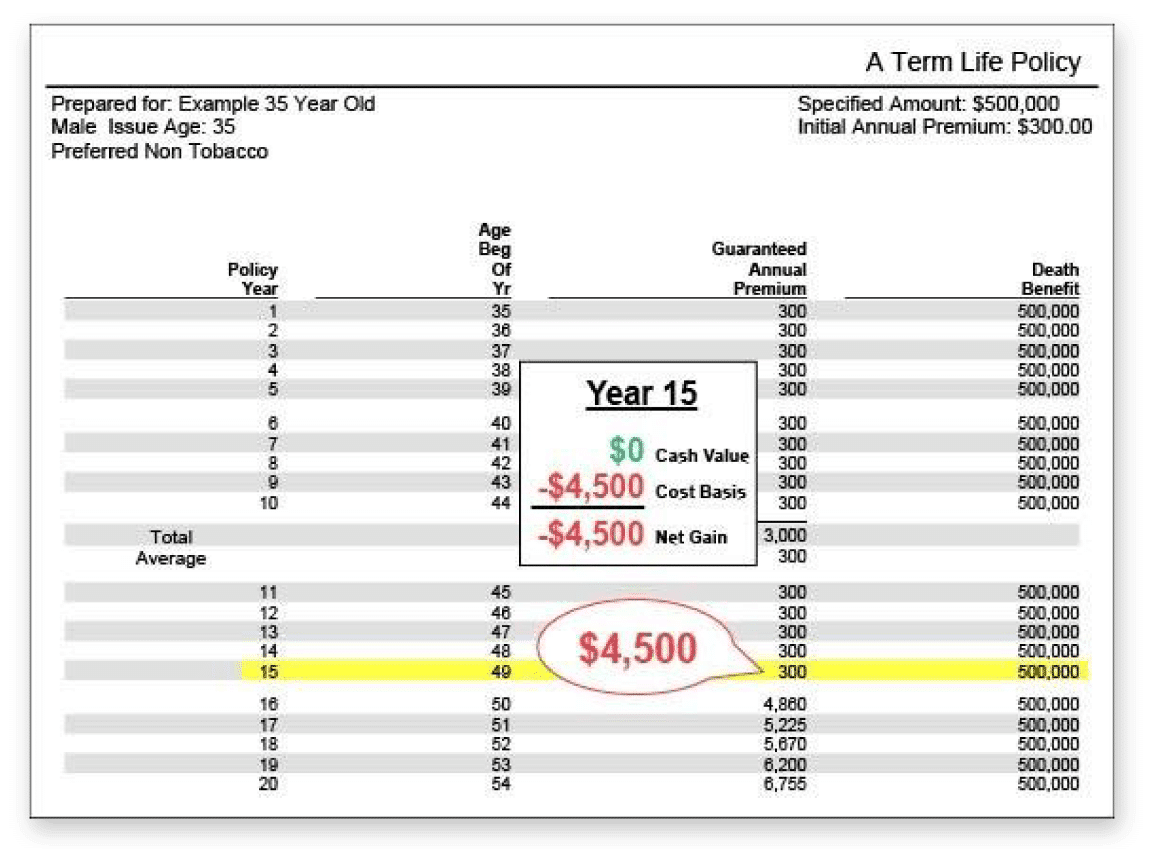

With degree term insurance coverage, the price of the insurance policy will certainly stay the very same (or possibly decrease if returns are paid) over the regard to your plan, typically 10 or twenty years. Unlike long-term life insurance coverage, which never ever ends as lengthy as you pay premiums, a degree term life insurance policy plan will finish at some point in the future, commonly at the end of the period of your degree term.

Due to the fact that of this, many individuals make use of permanent insurance policy as a stable monetary preparation tool that can serve several requirements. You might be able to transform some, or all, of your term insurance coverage throughout a collection duration, typically the first ten years of your policy, without requiring to re-qualify for coverage even if your wellness has altered.

30-year Level Term Life Insurance

As it does, you might desire to add to your insurance coverage in the future. As this occurs, you might desire to ultimately reduce your death advantage or consider converting your term insurance to a permanent plan.

Long as you pay your costs, you can relax very easy knowing that your enjoyed ones will get a fatality advantage if you die during the term (What is level term life insurance?). Several term policies permit you the capability to transform to irreversible insurance coverage without needing to take an additional health and wellness examination. This can allow you to capitalize on the added benefits of a permanent plan

Several irreversible policies will certainly include provisions, which define these tax obligation demands. There are two basic groups of long-term insurance coverage, standard and interest-sensitive, each with a number of variations. On top of that, each group is generally available in either fixed-dollar or variable kind. Conventional entire life plans are based upon lasting quotes of expenditure, rate of interest and death.

If these estimates alter in later years, the company will certainly readjust the premium appropriately yet never above the maximum assured premium mentioned in the plan. An economatic whole life policy offers for a fundamental quantity of participating whole life insurance with an added supplemental coverage supplied via making use of dividends.

Who are the cheapest Level Term Life Insurance Vs Whole Life providers?

Because the premiums are paid over a shorter period of time, the costs repayments will certainly be higher than under the entire life plan. Single premium whole life is minimal repayment life where one huge superior settlement is made. The plan is fully paid up and no further costs are called for.

Tax obligations will be sustained on the gain, nevertheless, when you surrender the policy. You might obtain on the cash money value of the plan, however remember that you may sustain a considerable tax bill when you give up, also if you have obtained out all the money value.

The benefit is that renovations in rates of interest will be shown quicker in interest sensitive insurance coverage than in conventional; the disadvantage, certainly, is that decreases in rates of interest will certainly also be really felt faster in rate of interest sensitive whole life. There are 4 basic rate of interest delicate whole life plans: The universal life policy is really more than interest sensitive as it is created to mirror the insurance provider's present death and expenditure along with rate of interest profits instead of historical rates.

What does Best Level Term Life Insurance cover?

The business credit scores your costs to the money value account. Periodically the firm deducts from the cash value account its expenditures and the cost of insurance coverage defense, typically explained as the death deduction cost.

Current assumptions are vital to rate of interest sensitive products such as Universal Life. Universal life is also the most flexible of all the numerous kinds of plans.

The plan typically gives you an option to pick 1 or 2 types of survivor benefit. Under one option your recipients received only the face amount of the plan, under the other they obtain both the face amount and the money value account. If you desire the optimum quantity of death benefit currently, the 2nd choice needs to be selected.

It is essential that these assumptions be reasonable since if they are not, you might need to pay even more to keep the plan from reducing or expiring. On the various other hand, if your experience is better after that the assumptions, than you might be able in the future to skip a costs, to pay less, or to have actually the plan paid up at an early date.

Guaranteed Level Term Life Insurance

On the other hand, if you pay even more, and your assumptions are realistic, it is feasible to compensate the policy at an early date (Best level term life insurance). If you surrender a global life plan you may receive less than the cash money value account because of abandonment charges which can be of 2 kinds

A back-end kind policy would certainly be better if you plan to preserve insurance coverage, and the fee decreases with every year you continue the policy. Remember that the rates of interest and cost and death costs payables initially are not ensured for the life of the policy. This kind of plan offers you maximum versatility, you will require to actively manage the policy to preserve sufficient funding, especially because the insurance policy business can boost mortality and expense fees.

You might be asked to make additional premium repayments where coverage can terminate because the rate of interest rate dropped. Your starting rate of interest is taken care of just for a year or in many cases three to 5 years. The ensured rate provided for in the plan is a lot lower (e.g., 4%). One more feature that is often stressed is the "no charge" loan.

In either case you must get a certificate of insurance coverage describing the provisions of the team policy and any insurance policy charge - Guaranteed level term life insurance. Normally the optimum quantity of insurance coverage is $220,000 for a mortgage and $55,000 for all other financial obligations. Credit report life insurance policy need not be acquired from the organization giving the finance

What is the process for getting Best Value Level Term Life Insurance?

If life insurance is called for by a lender as a problem for making a finance, you might be able to designate an existing life insurance policy, if you have one. Nonetheless, you may want to purchase group credit score life insurance policy even with its higher price since of its convenience and its availability, normally without comprehensive evidence of insurability.

In many cases, nonetheless, home collections are not made and costs are mailed by you to the representative or to the firm. There are certain elements that often tend to raise the costs of debit insurance policy even more than regular life insurance plans: Certain expenditures are the exact same no issue what the dimension of the plan, so that smaller sized policies issued as debit insurance coverage will have greater premiums per $1,000 of insurance policy than larger dimension routine insurance policies.

Since early lapses are costly to a firm, the prices have to be passed on to all debit insurance policy holders. Given that debit insurance policy is designed to consist of home collections, greater compensations and fees are paid on debit insurance policy than on normal insurance. In most cases these greater expenses are handed down to the insurance policy holder.

Where a firm has different premiums for debit and routine insurance policy it may be possible for you to buy a larger quantity of regular insurance than debit at no added expense. If you are believing of debit insurance coverage, you must definitely explore normal life insurance policy as a cost-saving alternative.

Who offers Level Term Life Insurance Companies?

This strategy is designed for those that can not originally manage the normal entire life costs but that desire the higher costs insurance coverage and feel they will become able to pay the higher costs. Level premium term life insurance. The family plan is a mix plan that provides insurance policy protection under one contract to all members of your instant household partner, spouse and youngsters

Joint Life and Survivor Insurance coverage provides coverage for 2 or more individuals with the fatality advantage payable at the death of the last of the insureds. Premiums are dramatically reduced under joint life and survivor insurance coverage than for plans that guarantee only one person, because the chance of having to pay a death case is reduced.

Table of Contents

Latest Posts

Seniors Funeral Cover

Funeral Insurance Expenses

Instant Term Life Insurance

More

Latest Posts

Seniors Funeral Cover

Funeral Insurance Expenses

Instant Term Life Insurance